Despite decarbonization targets, emissions from heavy-duty transport have risen steadily for decades — tailpipe emissions are estimated to have risen over 2% per year since 2000. After a slight drop during the pandemic, heavy-duty vehicles (HDV) emissions, particularly from freight transport, have continued to climb. HDVs are now are responsible for over 25% of road transport emissions in the EU while making up only 2% of the road transport fleet.

Among HDVs, trucks are a particular pain point for decarbonization and emissions reductions. Globally, heavy-duty trucks account for over 40% of freight emissions and are responsible for up to 80% of the increase in tailpipe CO2 emissions over the past two decades. Decarbonizing heavy-duty transport is emerging as a priority objective for local and national governments to meet transport decarbonization goals. Norway, the UK, EU, and California have all proposed or implemented bans on the sale of new diesel HDVs between 2030 and 2040.

Limits to Battery Electrification

While battery electric vehicles (BEVs) seem to be the clear pathway towards reaching net-zero passenger vehicles, electrification alone will not be sufficient to decarbonize heavy-duty transport. Several key characteristics of heavy-duty transport make BEV HDVs impractical:

- Charging time: Class 8 long-haul trucks that require roughly 1-2MWh batteries can take up to several hours to fully charge, increasing trip times by up to 35%. For logistics and freight fleets already operating on narrow margins, this additional drive time is not economically feasible.

- Payload: The batteries required for heavy-duty commercial vehicles significantly reduce available cargo capacity — potentially over 8,000 pounds. Reduced cargo capacity and increased vehicle weight also negatively impact the operational economics, and significantly increase the payback time on the upfront cost of purchasing a BEV HDV.

- Charging infrastructure: Physical infrastructure deployment and electrical power requirement:

- Charging stations for HDVs require significantly more space than passenger car charging stations due to the longer charge time of the larger vehicles. High use rate and shorter range also increases the number of stations required across long-haul routes.

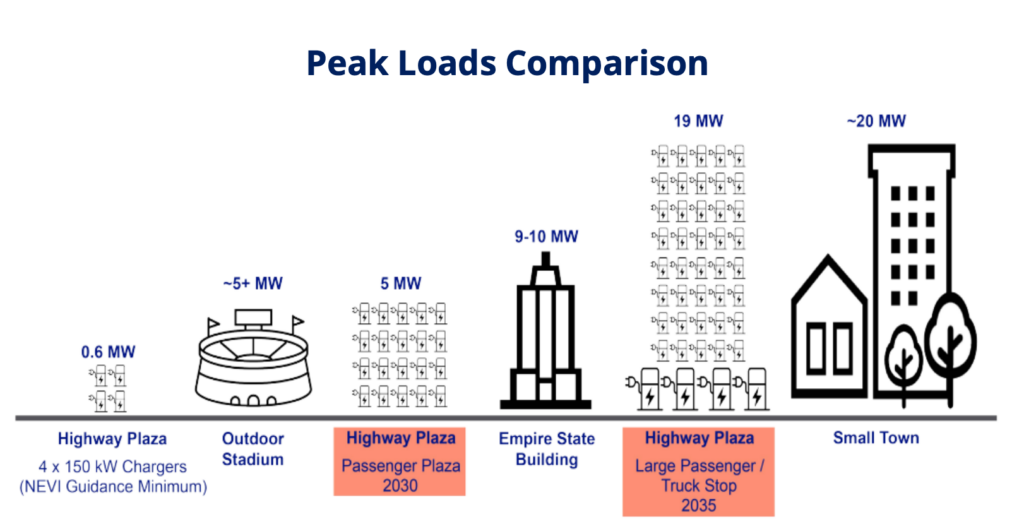

- Megawatt charging places a massive demand on the electrical grid. Widespread megawatt charging would require a combination of onsite renewable energy generation and energy storage.

Hydrogen Use Case: Long-haul and Back-to-base Transport

Using hydrogen to fuel HDVs (either with hydrogen combustion engines or hydrogen fuel cells) addresses several of the challenges facing BEVs in the heavy-duty transport sector. Namely, the charge time for heavy-duty hydrogen trucks is 10-15 minutes, comparable to conventional diesel vehicles. Similarly, payload is minimally affected, particularly for long-haul and heaviest-duty vehicles.

While hydrogen fuel cell vehicles (HFCEV) utilize both battery packs and hydrogen fuel cell systems, the batteries are significantly smaller than fully BEVs. Hydrogen trucks also have the competitive advantage in terms of range in comparison to BEVs, with newer models reaching up to 800 miles. Longer-range, shorter refuelling times, and increased cargo capacity improve the economics of hydrogen HDVs, shortening payback time and increasing productivity for fleet operators.

Challenges and Innovation

- Hydrogen trucks are currently 2x-4x the price of diesel trucks, which is prohibitive for most fleets.

- With hydrogen storage, high-volume, low-mass gas must be stored either at high pressure or cryogenic temperatures:

- Storage tank weight and size impact payload and range — pressurization and cryogenic temperatures raise safety concerns.

- Lack of established refueling infrastructure and limited vehicle availability stall customer uptake — chicken or egg – not enough vehicles to justify infrastructure development, lack of infrastructure stalls vehicle uptake.

Innovators are addressing these challenges, engaging across the value chain to provide hydrogen refueling solutions, storage, and fuel cell system optimization, as well as fast-tracking vehicle availability and production.

- Retrofitsof diesel trucks for hybrid fuel compatibility or hydrogen fuel cell powertrain eliminates upfront cost of purchasing new fleet vehicles. The shorter production process gets vehicles on the road much faster than bespoke vehicle production (e.g., Hyzon Motors).

- Software solutions optimize diesel displacement and hydrogen fuel use (g., Hydra Energy).

- Hydrogen storage: Cryo-compressed and sub-cooled hydrogen increase energy density and allow for increased range, payload, avoid the high cost of liquefaction, and reduce fuel losses (e.g., Verne).

- Refueling: Innovation is evident in modular refueling services, hydrogen-as-a-service, and vertically-integrated hydrogen producers (e.g., Pure Hydrogen).

- Green hydrogen producers are engaging in ecosystem-building, bespokeinfrastructure, vehicle procurement, and refueling solutions (e.g., Phynix).

Looking Forward

Hydrogen availability and cost are key uncertainty factors for fleet operators looking to acquire net-zero HDVs. Green hydrogen production and fuel mandates, zero emissions vehicle subsidies and incentives, and federal funding for fueling infrastructure will make hydrogen HDVs a more attractive option.

Meanwhile, retrofitting existing diesel HDVs for hydrogen will be crucial to get hydrogen HDVs on the road, perform larger-scale pilots, and justify the deployment of widespread hydrogen refueling infrastructure. Keep an eye out for activity from major auto incumbents. All of the largest truck manufacturers have announced production or launched pilots of hydrogen HDVs in recent years. Expect vehicles from OEMs to hit the roads in the last 2020s.