Photograph by D Ramey Logan, CC BY 4.0

Chinese Drone Market: Leading the Way in Innovation and Scale

For more detailed insights into the Chinese drone market, you can access the full report on DRONEII’s website or contact them directly for a comprehensive study.

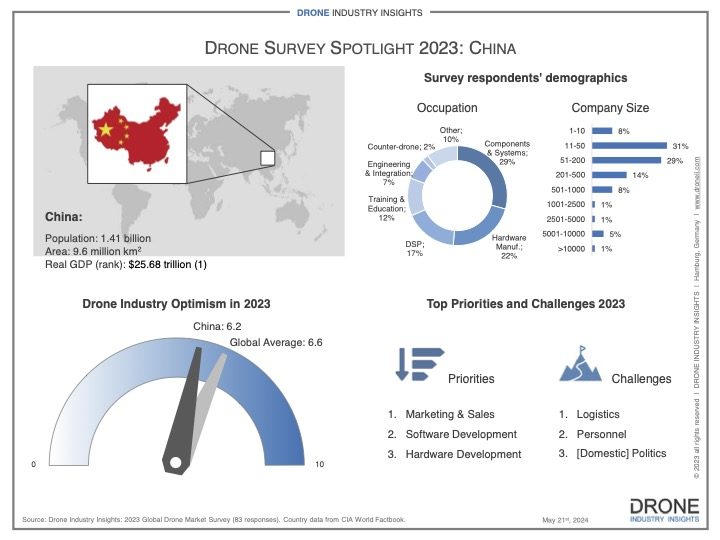

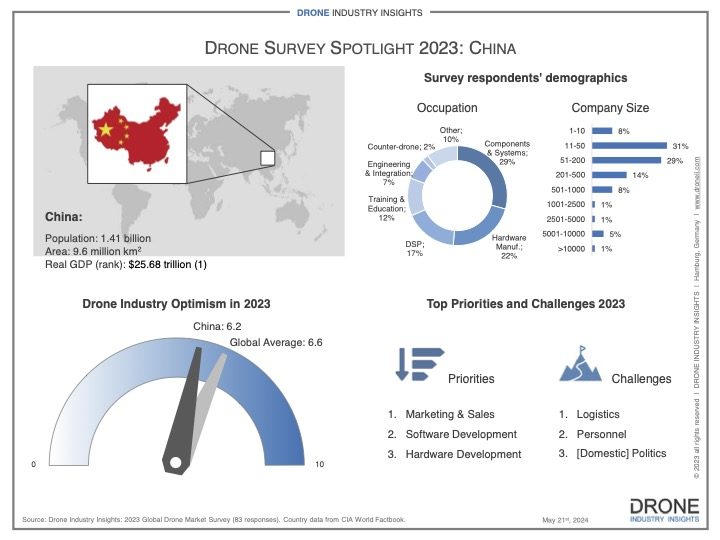

In the latest report by Drone Industry Insights (DRONEII), the Chinese drone market has been highlighted as a significant global player, showcasing its extensive capabilities and continued potential for growth. As DRONEII’s Ed Alvarado writes, despite DJI’s dominance, China’s broader drone industry remains a powerful advocate for commercial drones, with three of the top five civil drone manufacturers hailing from the country. This insight, drawn from DRONEII’s latest country series, provides a first-hand look at the dynamic and rapidly evolving Chinese drone sector.

Market Opportunities

While China is already the leading commercial drone market, the full potential of drones in the country has yet to be realized. Large-scale advanced operations, such as Beyond Visual Line of Sight (BVLOS), nighttime flights, and flights over people, are still in the early stages. Given China’s vast population of 1.41 billion and its leading economy, the opportunities for drone applications are immense.

From maritime routes to drone light shows and innovative drone components, China continues to make headlines with its drone activities. However, the lack of Western media coverage may be due to communication barriers rather than a shortage of activities within the Chinese drone market.

Market Composition

The composition of Chinese drone companies reveals unique insights. Unlike the rest of the world, where Drone Service Providers (DSPs) are typically the most common, Chinese companies primarily focus on Components & Systems (29%) and Hardware Manufacturing (22%), with DSPs only making up 17% of the market. This emphasis on hardware and components underscores China’s reputation as a manufacturing powerhouse.

Moreover, Chinese drone companies tend to be larger than their global counterparts. An estimated 61% of these companies have over 50 employees, and 16% have over 500 employees. This contrasts sharply with other countries, where drone companies are generally smaller operations.

Priorities and Challenges

Marketing & Sales is the top priority for Chinese drone companies, followed by software development and hardware development. The challenges faced by these companies include logistics, which is a unique challenge in the country series. Given China’s vast geography and large population, logistics is a significant concern, particularly for companies exporting globally. Other challenges include personnel shortages and domestic politics, reflecting the complexities of operating in a tech-heavy industry within a large and politically unique country.

Unique Market Dynamics

Despite the slight dip in optimism among Chinese drone companies compared to the global average, the market is expected to continue its growth trajectory, leading both Asia and the world. The report highlights other high-performing Chinese drone companies such as JOUAV, Autel Robotics, and XAG. Notably, EHang, a leading eVTOL company, has begun operations within China, reflecting the unique regulatory environment facilitated by the country’s centralized government.

The insights from DRONEII’s report underscore the unique and powerful nature of the Chinese drone market. As the industry continues to evolve, China’s role as a leader in drone technology and innovation is expected to grow even further.

Read more:

Miriam McNabb is the Editor-in-Chief of DRONELIFE and CEO of JobForDrones, a professional drone services marketplace, and a fascinated observer of the emerging drone industry and the regulatory environment for drones. Miriam has penned over 3,000 articles focused on the commercial drone space and is an international speaker and recognized figure in the industry. Miriam has a degree from the University of Chicago and over 20 years of experience in high tech sales and marketing for new technologies.

For drone industry consulting or writing, Email Miriam.

TWITTER:@spaldingbarker

Subscribe to DroneLife here.